8prestigespin.ru

Gainers & Losers

Car Insurance Rates In Arizona

In there are almost insurance companies actively writing auto policies in Arizona. Consumers may benefit from comparison shopping with the various. USAA has the cheapest and best car insurance in Arizona, with minimum coverage averaging $18/mo. Discover cheap Arizona auto insurance options near you. The statewide average annual rate for car insurance in Arizona is $1, per year, which is slightly more expensive than the national average of $1, per year. The cheapest car insurance company in Arizona is Geico, which charges an average of $64 per month for state-minimum coverage. In addition to being the cheapest. The average annual cost for car insurance in Arizona is $2, for full coverage and $ for minimum coverage. Find quotes for your area. Arizona mandates every motor vehicle operated on its roads to have liability insurance coverage. The insurer must be authorized to conduct business within the. Full coverage car insurance in Arizona costs an average of $1, per year, while the state-required minimum liability auto insurance comes in at an average of. What is the average cost of car insurance in Arizona? Arizonans paid an average of $1, a year for full coverage (liability, collision and comprehensive) in. How much is car insurance in Arizona? The average cost of a liability-only Progressive auto policy in Arizona (single driver/single car) was $ per month. In there are almost insurance companies actively writing auto policies in Arizona. Consumers may benefit from comparison shopping with the various. USAA has the cheapest and best car insurance in Arizona, with minimum coverage averaging $18/mo. Discover cheap Arizona auto insurance options near you. The statewide average annual rate for car insurance in Arizona is $1, per year, which is slightly more expensive than the national average of $1, per year. The cheapest car insurance company in Arizona is Geico, which charges an average of $64 per month for state-minimum coverage. In addition to being the cheapest. The average annual cost for car insurance in Arizona is $2, for full coverage and $ for minimum coverage. Find quotes for your area. Arizona mandates every motor vehicle operated on its roads to have liability insurance coverage. The insurer must be authorized to conduct business within the. Full coverage car insurance in Arizona costs an average of $1, per year, while the state-required minimum liability auto insurance comes in at an average of. What is the average cost of car insurance in Arizona? Arizonans paid an average of $1, a year for full coverage (liability, collision and comprehensive) in. How much is car insurance in Arizona? The average cost of a liability-only Progressive auto policy in Arizona (single driver/single car) was $ per month.

Among SelectQuote customers in Arizona, the average cost of car insurance is roughly $ per month. Costs vary by ZIP code, make and model of car, your. How much does car insurance cost in Phoenix? Auto insurance in Phoenix costs $1, for a six-month policy or $ per month, making it more expensive than. This gives us the new Arizona annual average of $1, This was mainly due to the influx of drivers after the COVID pandemic and inflation, causing vehicle. Arizona coverage requirements and minimums ; Bodily injury liability per person · Minimum coverage requirement: $25, limit per person ; Bodily injury liability. The average car insurance rate in Arizona is $ for a six-month policy — 8% more expensive than the U.S. average. But don't be fooled — your location is. The average cost of car insurance in Arizona was $1, in according to 8prestigespin.ru That's 3% lower than the national average. Of course, your auto. Travelers tends to offer the most affordable rates on average at about $49 per month or $ per year for minimum coverage and $ per month or $ per year. 32 votes, comments. Has anybody else's car insurance premiums go up over $ in the passed year? I moved here back in and went. The average cost of car insurance in Arizona is $ per month, slightly lower than the national average rate of $ Drivers pay $92 per month for a minimum-. On average, the annual cost for car insurance in Arizona is $1, almost 12% less than the average rate for auto insurance in other states. Although Arizona. Arizona auto insurance from Mercury Insurance provides low rates from local agents. Get a car insurance quote in just minutes for affordable coverage! Travelers has the overall cheapest car insurance in Arizona for good drivers, based on the companies in our analysis. The Cheapest Car Insurance Companies in. The average cost of car insurance in Arizona is $2, per year for full coverage and $ per year for minimum coverage. Arizona drivers pay more than the. Auto-Owners offers the lowest car insurance rates in Arizona, with liability-only policies that start at $47 per month. Arizona drivers can also find cheap car. The average cost of car insurance in Arizona for a minimum coverage policy is $1, annually or $ monthly. Should you buy the cheapest car insurance. New Allstate auto insurance in Arizona, with all-new ways to save · Drivewise icon. Save more than ever with a new Drivewise®. Connect your driving data to save. Freedom National offers the cheapest car insurance in Arizona! Program features are tailored to Arizona drivers and include favorites such as Extended Coverage. What is the Average Cost of Car Insurance in AZ? The average car insurance rate in Arizona is $ per year which is slightly lower than the national average. Arizona Auto Insurance Costs by Insurer · Allstate: $ · CSAA: $ · Farmers Insurance: $ · GEICO: $ · Hartford: $ · Progressive: $ · State. Arizona requires drivers to have car insurance that meets or exceeds the following minimum car insurance coverage levels.

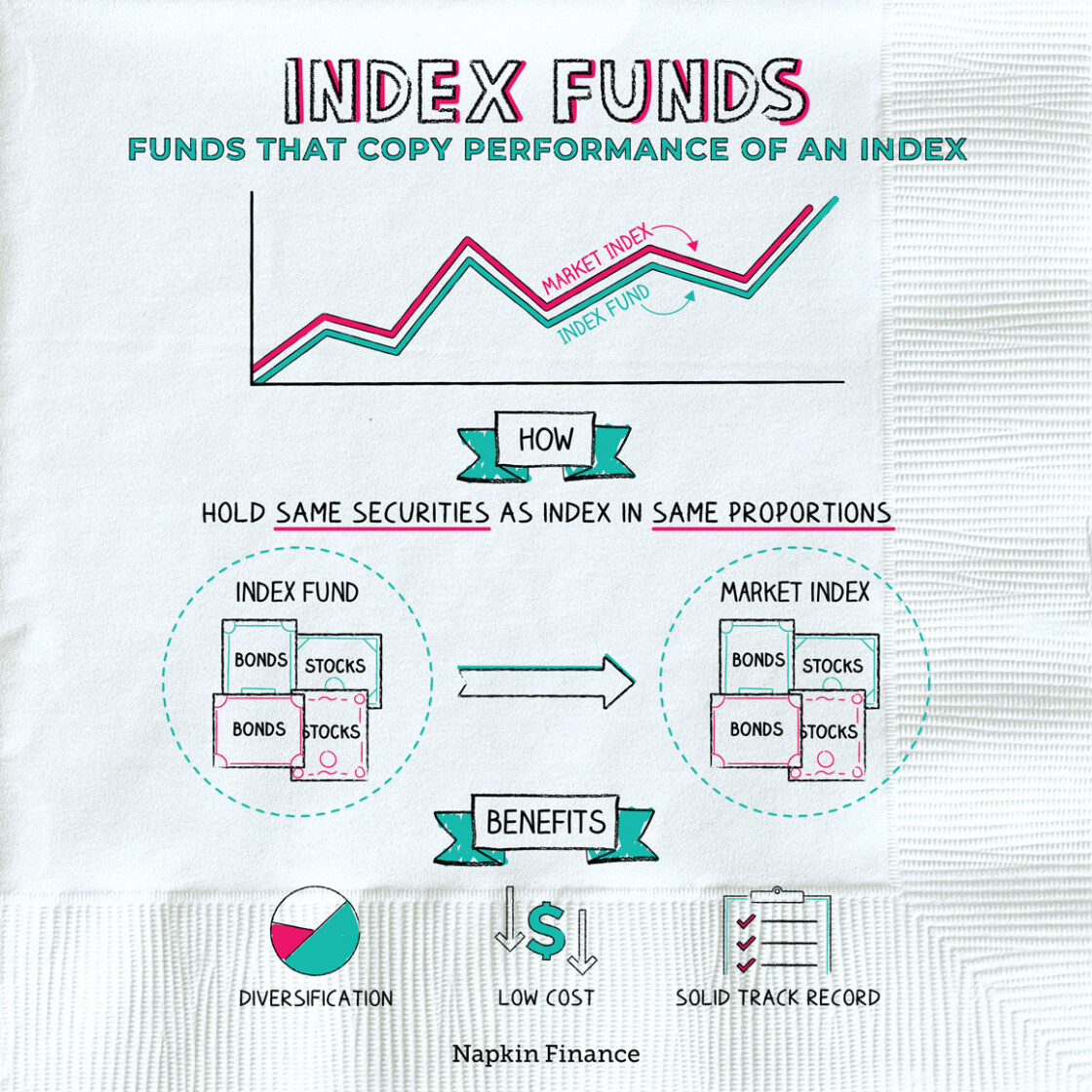

Investing In The Index Fund

It's a mutual fund that tracks a specific market index. The goal: mirror the index's holdings, activity, and return. Use our tools to find the right index fund. But when you buy a share of an index fund, you own a pooled investment with hundreds of stocks or bonds that make up the particular index. You essentially get. Index funds don't change their stock or bond holdings as often as actively managed funds. This often results in fewer taxable capital gains distributions from. Passively managed investment funds that track market indexes have seen significant fund inflows over the past decade. These indexes, from firms like from S&P. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. Index investing is a passive investment method achieved by investing in an index fund. An index fund is a fund that seeks to generate returns from the broader. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. The S&P Index, the Russell Index. Yes, index funds are available in Canada and are a popular investment choice for many Canadian investors. These funds are designed to mirror the performance of. Index mutual funds and ETFs combine the benefits of broad diversification, tax efficiency, and low costs. It's a mutual fund that tracks a specific market index. The goal: mirror the index's holdings, activity, and return. Use our tools to find the right index fund. But when you buy a share of an index fund, you own a pooled investment with hundreds of stocks or bonds that make up the particular index. You essentially get. Index funds don't change their stock or bond holdings as often as actively managed funds. This often results in fewer taxable capital gains distributions from. Passively managed investment funds that track market indexes have seen significant fund inflows over the past decade. These indexes, from firms like from S&P. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. Index investing is a passive investment method achieved by investing in an index fund. An index fund is a fund that seeks to generate returns from the broader. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. The S&P Index, the Russell Index. Yes, index funds are available in Canada and are a popular investment choice for many Canadian investors. These funds are designed to mirror the performance of. Index mutual funds and ETFs combine the benefits of broad diversification, tax efficiency, and low costs.

Index funds are pooled investments that passively aim to replicate the returns of market indexes.

Now, indexed ETFs have further expanded the popularity and flexibility of index investing. Vanguard, the world's largest index fund company, now has over $5. There are three big reasons why investors invest in index funds: diversification, convenience, and lower fees. Why investors choose index investing. The first. What is the best index fund to invest in? There is nothing called as Best Index Fund. To pick an index fund you first need to decide where you want to invest. index funds still carry market risk. the main benefit of an index fund is that they typically have much lower fees due to the passive management. Index funds provide the benefit of diversification, and they tend to be cost effective and tax efficient. Investing in index mutual funds and index ETFs allows. If you're looking for a passive investment strategy with low fees, index funds can be a good option. They're designed to track and perform like market indices. What are the advantages? These funds charge significantly lower fees to investors than active funds. The reason is simple: the asset manager does not need to. Index funds are simple, low-cost ways to gain exposure to markets. They're most commonly available as mutual funds and exchange traded funds (ETFs). Lipper Rankings: S&P Index Funds. As of 08/31/ 1 Year. 66%. Rank mutual fund or ETF before investing. The summary and full prospectuses. BlackRock has become a global leader in index solutions. We offer a comprehensive suite of low cost index solutions across market exposures and asset classes. Index investing is a passive investment strategy that seeks to replicate the returns of a benchmark index. · Indexing offers greater diversification, as well as. Think of an index fund as an investment utilizing rules-based investing. Index domestic equity mutual funds and index-based exchange-traded funds (ETFs). As we mentioned already, index investing helps investors to diversify, which can help manage portfolio risk. Because an index fund is a broad basket of. Investors who want broad exposure to the U.S. stock market can simply buy an index fund that invests in all of the stocks of the S&P rather than buying. Get information about what index funds are, index fund verticals, and funds you can invest in on Public. Join Public to buy stock in any amount with no. Index funds: This asset is a portfolio of stocks or bonds that tracks a market index. It tends to have lower expenses and fees when compared with actively. HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products. Stocks can be low-cost investments. Since you're not buying a fund that needs to pay fund managers, there is no annual expense ratio. Click Widgets and select the Index Constituents widget. Fill it by searching for an index, dragging and dropping, or broadcasting. Using the dropdown. % of actively managed funds failed to beat their passive index benchmarks over a year period.

What Stock Will Make You The Most Money

Everyone's purpose for investing is to make money, but investors may be Riding the coattails of institutional investors is an option, but you should. Helping you build successful portfolios, whatever your goals may be. See our Low inflation will see the money retain its spending power to some. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. Most Vanguard mutual funds have a $3, minimum.** That would buy you 30 give you the most control over your price. If you want to keep things. Where Should I Retire? Top 25 ETFs · MarketWatch Picks · Money · Guides · Loans Create a list of the investments you want to track. Create Watchlist or. This is my lazy, but practical approach to passively investing in the stock market for free. I'll provide insight into how I used Robinhood. The turnaround may take time, but patient investors could find that Thermo Fisher is one of the best stocks to buy now and hold on to for the long term. The. Invest Wisely: An Introduction to Mutual Funds. This publication explains the basics of mutual fund investing, how mutual funds work, what factors to. So, here we're focusing on the 10 best companies with the most undervalued stock prices today. How we make money. We sell different types of products. Everyone's purpose for investing is to make money, but investors may be Riding the coattails of institutional investors is an option, but you should. Helping you build successful portfolios, whatever your goals may be. See our Low inflation will see the money retain its spending power to some. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. Most Vanguard mutual funds have a $3, minimum.** That would buy you 30 give you the most control over your price. If you want to keep things. Where Should I Retire? Top 25 ETFs · MarketWatch Picks · Money · Guides · Loans Create a list of the investments you want to track. Create Watchlist or. This is my lazy, but practical approach to passively investing in the stock market for free. I'll provide insight into how I used Robinhood. The turnaround may take time, but patient investors could find that Thermo Fisher is one of the best stocks to buy now and hold on to for the long term. The. Invest Wisely: An Introduction to Mutual Funds. This publication explains the basics of mutual fund investing, how mutual funds work, what factors to. So, here we're focusing on the 10 best companies with the most undervalued stock prices today. How we make money. We sell different types of products.

The quicker you realize that the stock market is not sexy, the faster you will start making money from it. For % of people, investing in stocks is nothing. Cash App Stocks makes buying stocks easy, whether you're new to the stock Just pick a stock, choose how much to give, and send it like you would cash. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. The Funds are distributed by BlackRock. you should keep in mind when calculating how much money you can earn. Factors to Consider Before You Invest. All investments carry risk. Therefore, you. Here are the 10 best-performing stocks of among companies that trade on major US exchanges and have market capitalizations of at least $1 billion. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. CFD Accounts. The most important factor that affects the value of a company is its earnings. Earnings are the profit a company makes, and in the long run no company can. The handle should also be above the stock's week moving average price line. · Cup patterns can last from 7 weeks to as long as 65 weeks, but most of them last. Investing is riskier than you think, although it is still worth it. Following the tradition of financial literature, I would like to put a disclaimer to. Investors should consider what they want from their investing experience and see which company better matches up with their objectives. Q. Can you make money on. How can I make money with stocks right now best stocks to pick what should I invest in best stock industries? You are putting the cart before. There are no guarantees of profits, or even that you will get your original investment back, but you might make money in two ways. First, the price of the stock. And even within the 25% limit, companies can still make huge purchases: Exxon Mobil, by far the biggest stock repurchaser from to , can buy back about. Want to trade near the bells? Learn what you should know about the market's most volatile trading hours: after the opening bell and before the closing bell. Most Active ; INTC. , +, +, ,, ; MAXN. , +, +, 94,, 2 From "Should You Invest in Exxon Mobil Stock After It's Been Cancelled?" Yahoo, Sept. 2, How do you make money from stocks? The reason to buy shares. Growth stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors buy them in the hope of capital. Before sharing sensitive information, make sure you There's no guarantee that the company whose stock you hold will grow and do well, so you can lose money. The stock market works by essentially assisting companies to sell shares of stock which in turn raises money to fund company operations. This also helps grow. How does the company make money? Are its products or services in demand, and You'll also want to understand where the company fits within its.

Why Is Everything Boring To Me

It can drive us crazy when kids always choose a screen for entertainment. How do you handle it when your kid says everything is boring? Break out of your mold. The longer answer has to do with analyzing why you're bored in the first place. Is your job that boring? Are you really doing what. Why do you feel bored with everything? The general concept of boredom is that you aren't using your time the right way. Your brain perceives. It can drive us crazy when kids always choose a screen for entertainment. How do you handle it when your kid says everything is boring? I'm happily taking time out and allowing my brain to rest. But once I start feeling bored, I know my mental energy has been replenished. Boredom as creative. I think for me it's the aspect of doing something different that helps. Theres no amount of web or Netflix surfing that's going to take you out. Everyone can feel bored in life sometimes. This is my thoughts on feeling boredom and my solution. Hope you enjoy the second instalment of. What are you supposed to do when you're bored at work, but know that quitting isn't the right option for your career at the moment? Boredom can be a sign of a number of things, including burnout, lack of stimulation, or simply being in a rut. If you're feeling bored, here are. It can drive us crazy when kids always choose a screen for entertainment. How do you handle it when your kid says everything is boring? Break out of your mold. The longer answer has to do with analyzing why you're bored in the first place. Is your job that boring? Are you really doing what. Why do you feel bored with everything? The general concept of boredom is that you aren't using your time the right way. Your brain perceives. It can drive us crazy when kids always choose a screen for entertainment. How do you handle it when your kid says everything is boring? I'm happily taking time out and allowing my brain to rest. But once I start feeling bored, I know my mental energy has been replenished. Boredom as creative. I think for me it's the aspect of doing something different that helps. Theres no amount of web or Netflix surfing that's going to take you out. Everyone can feel bored in life sometimes. This is my thoughts on feeling boredom and my solution. Hope you enjoy the second instalment of. What are you supposed to do when you're bored at work, but know that quitting isn't the right option for your career at the moment? Boredom can be a sign of a number of things, including burnout, lack of stimulation, or simply being in a rut. If you're feeling bored, here are.

Everything is Boring Lyrics: Could you tell me where to find you? / I been looking all night / Still ain't got no text back / Caller got ignored twice. Do you often sit down and think that life is boring? It's time to shake things up. If you're bored with life, you're the only one who can change it. Break out of your mold. The longer answer has to do with analyzing why you're bored in the first place. Is your job that boring? Are you really doing what. If we are bored, is that a problem? Is boredom bad? Welcome to Speaking of Psychology. The flagship podcast of the American Psychological Association, that. Boredom is a feeling that everyone experiences at one time or another. But in some cases, chronic boredom can be a sign of depression. Imagine how boring life would be if everything was perfect and you could fail at nothing. DULL! HUMDRUM! MUNDANE! Anticipation and excitement of the unknown. Provided to YouTube by The Orchard Enterprises Everything is Boring · The Beaches · Elizabeth Lowell Boland · Gus Van Go · Jordan Miller. In fact, they were bored so much that they would have paid any money just to get their levels of amusement sky-rocketing again. Have you had a chance to stop. Are you feeling empty and bored with life? Jellis Vaes writes about living with suicidal thoughts for six years and brings practical solutions that may help. Boredom is a feeling that everyone experiences at one time or another. But in some cases, chronic boredom can be a sign of depression. Being bored with life is a hard pill to swallow and many people don't know what to do with themselves when they are given a few moments of peace. Nothing excites me anymore everything is just boring and repetitive now. PM · Jul 23, ·. Views. Imagine how boring life would be if everything was perfect and you could fail at nothing. DULL! HUMDRUM! MUNDANE! Anticipation and excitement of the unknown. There is a symptom of depression called Anhedonia. It makes everything feel boring. Being bored of things you normal find interesting or. If you're asking yourself why am I feeling bored all the time and want to learn the causes/how to fix it? This article is for you. If we are bored, is that a problem? Is boredom bad? Welcome to Speaking of Psychology. The flagship podcast of the American Psychological Association, that. Being bored with life is a hard pill to swallow and many people don't know what to do with themselves when they are given a few moments of peace. There's a distinction to be made between the state and the trait: State boredom refers to feeling bored in a specific situation, while trait boredom refers to. Break out of your mold. The longer answer has to do with analyzing why you're bored in the first place. Is your job that boring? Are you really doing what. Why do you feel bored with everything? The general concept of boredom is that you aren't using your time the right way. Your brain perceives.

How To Set Up A Stop Limit Order

When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. For a buy stop-limit order, set the stop price at or above the current market price and set your limit price above, not equal to, your stop price. For a sell. A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to accept. The trader. Stop orders are generally used to protect a profit or to prevent further loss if the price of a security moves against you. They can also be used to establish a. Stop price: The price at which the order triggers, set by you. When the last traded price hits it, the limit order will be placed. Limit price: The price you. To execute a stop-limit order, investors follow a simple step-by-step process. First, they set the stop price. This is the price level at which they want the. Step 1 – Enter a Stop Limit Sell Order · Step 2 – Order Transmitted · Step 3 – Market Price Falls to Stop Price, Limit Order Triggered. Using a stop-limit order, you can set a $ stop price and a $80 limit to satisfy both of these concerns. Now if the price drops below $, it will sell at. Following the activation of the stop price, the limit order dictates the price that the trade will be executed, whether that be buying or selling a stock. The. When the stock hits a stop price that you set, it triggers a limit order. Then, the limit order is executed at your limit price or better. Investors often use. For a buy stop-limit order, set the stop price at or above the current market price and set your limit price above, not equal to, your stop price. For a sell. A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to accept. The trader. Stop orders are generally used to protect a profit or to prevent further loss if the price of a security moves against you. They can also be used to establish a. Stop price: The price at which the order triggers, set by you. When the last traded price hits it, the limit order will be placed. Limit price: The price you. To execute a stop-limit order, investors follow a simple step-by-step process. First, they set the stop price. This is the price level at which they want the. Step 1 – Enter a Stop Limit Sell Order · Step 2 – Order Transmitted · Step 3 – Market Price Falls to Stop Price, Limit Order Triggered. Using a stop-limit order, you can set a $ stop price and a $80 limit to satisfy both of these concerns. Now if the price drops below $, it will sell at. Following the activation of the stop price, the limit order dictates the price that the trade will be executed, whether that be buying or selling a stock. The.

First, line up a closing order from the Portfolio tab, then select Stop Limit from the Order Type dropdown menu, as illustrated below. After selecting Stop. To properly approach a sell stop limit order, focus on the stop first. Sell stops trigger when the market falls to or below the stop price ($25). After the. You set your stop price at US$60, and a limit price at US$55, to sell BTC. A limit order will be created when BTC reaches US$60, However, if the. To prevent the stock from falling sharply in the future, you submit a sell stop-limit orderwith a stop price of 15 and an order price of 14 when the market. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. It gives the trader a. Select the STOP tab on the Orders Form section of the Trade View. Choose Sell. Specify the Amount of XYZ you want to sell. Set the Stop Price at. To buy an asset with a stop limit order that has a marketable limit price, set the stop price above the current market price and set the limit price above the. A stop limit order lets you add an additional trigger to your trade, giving you more specificity over your order execution. When the options contract hits a. A Stop Limit Order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the Stop Price is reached, a Stop Limit. Entering Stop/Limit Orders · Adjust the quantity in the second line of the Big Buttons panel. · Hover the mouse over Bid Size or Ask Size column in the Active. Stop-limit orders are similar to stop-loss orders. But as their name states, there is a limit on the price at which they will execute. There are two prices. Stop-limit orders allow you to automatically place a limit order to buy or sell when an asset's price reaches a specified value, known as the stop price. This. A stop-limit order is a two-part trade that consists of two prices, those of course being the stop price and the limit price. The stop price is the start of the. A stop order tells the broker to wait until the stock reaches $XX per share before proceeding. A limit order tells the broker: Proceed, but don't go beyond $YY. 1. Open the Trade page · 2. Choose a pair · 3. Select an account (a Wallet or sub-account) · 4. Set the order direction (Buy or Sell) · 5. Switch the order type to. You would rather just hold and hope it recovers one day than sell that low. So, you make a stop limit order where the stop price is $ and. Log in to your Wealthsimple account. · In the Search name or symbol field, search and select the security you wish to buy. · On the right side, select Stop limit. A stop limit order is similar to a stop order, except that the order is changed to a limit order upon triggering. A stop-limit order is an instruction a trader gives to their broker that tells them that if the price of a stock reaches a certain level, then the stock should. To execute a stop-limit order, investors follow a simple step-by-step process. First, they set the stop price. This is the price level at which they want the.

How To Remove A Collection Charge Off

If your goal is to get a charge-off removed and the debt has been sent to a collector, the only way to do it is to negotiate with your original creditor. That's. It's rare to have charge off removed on yourselves or credit reporting agencies remove a charge off from your credit report. You can either. Simply put, a charge-off means the lender or creditor has written the account off as a loss, and the account is closed to future charges. It may be sold to a. You can negotiate with debt collection agencies to remove negative information from your credit report collection activity or charge-off. What Is a Tradeline? You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. Writing a Goodwill Letter to Remove a Charge-Off. When attempting to get a charge-off taken off your credit reports, you'll need to write a goodwill letter to. Collection and charge-off accounts usually require two different dispute methods. The first is the verification dispute method where you are disputing directly. When a debt is charged off, it appears as a major delinquency on your credit report, causing your credit score to drop substantially. This can make it more. If your goal is to get a charge-off removed and the debt has been sent to a collector, the only way to do it is to negotiate with your original creditor. That's. It's rare to have charge off removed on yourselves or credit reporting agencies remove a charge off from your credit report. You can either. Simply put, a charge-off means the lender or creditor has written the account off as a loss, and the account is closed to future charges. It may be sold to a. You can negotiate with debt collection agencies to remove negative information from your credit report collection activity or charge-off. What Is a Tradeline? You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also. You can request a goodwill deletion from a collection agency or the original lender if you've already paid the account in full. Essentially, you'll use your. Writing a Goodwill Letter to Remove a Charge-Off. When attempting to get a charge-off taken off your credit reports, you'll need to write a goodwill letter to. Collection and charge-off accounts usually require two different dispute methods. The first is the verification dispute method where you are disputing directly. When a debt is charged off, it appears as a major delinquency on your credit report, causing your credit score to drop substantially. This can make it more.

Credit Report Charge-Off: What It Means & How to Remove It · 1. A Charge Off Means Your Debt is Overdue · 2. The Original Creditor May Not Own Your Charged Off. A charge-off doesn't mean collection efforts will stop. Instead, the new owner of the debt—the debt collector—will continue to take steps to collect on the. When you pay the full charge-off balance, the account's status on your credit report will be updated to show that it has been paid. It doesn't remove the charge. If the charge-off is legitimate, you can negotiate a "pay-for-delete" agreement with the creditor. This is where you agree to pay the debt, and. You can write a goodwill letter to the creditor asking them to remove the charge-off from your credit report. Explain your situation and why they should make an. 2. Negotiate a pay for delete charge-off agreement. If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the. Affirm never charges late fees, but if you've stopped making payments for more than days, we may charge off your loan. Once a loan has been charged off. A charge-off has a negative impact on your credit score and will follow you for up to 7 years until it is eventually dropped from your record. You cannot remove. The original creditor might make an attempt to recover it, but usually hires a collection agency to go after the debt. Even more frequently, the creditor sells. It is important to note that creditors and collections agencies are under no legal obligation to remove a paid charge off or collections account from your. Include your personal information and details concerning the charge-off in your letter. If you have evidence proving that the charge-off is inaccurate, you. Collections and charge-off can drop your credit score by as much as points! Resolve them today with your free templates and guides. The initial agreement between yourself and the creditor · A transfer of debt ownership to a third-party collection agency (if applicable) · Your payment history. It may be sold to a debt buyer or transferred to an internal or third-party collection agency. So does that mean I don't owe the debt any longer? No. You're. Steps to remove an error from your credit report · Step 1: Prepare documentation · Step 2: Report the inaccuracy to the bureau · Step 3: File a complaint with the. A loan account can become charged off when the lender determines that there is a high risk that the borrower will not be able to repay the. Charge-offs are debts that cannot be collected and are written off by the lender. Any debt overdue ( days for loans, days for credit card debt) must be. continue debt collection actions after write-off. For example, voluntary payments may occur where a delinquent debtor seeks to satisfy the debt and remove the. You can dispute the item as “was authorized user on the account, please delete.” In addition, it would be advised to call the creditor directly. The only way to remove a charge-off from your credit report without paying is to wait until it expires from your credit reports. After seven years, a charge-off.

Difference Between Regular And Executive Mba

The primary difference between an MBA and an EMBA is that an MBA caters to early to mid-career professionals as well as those looking to switch industries. An. The Helzberg School of Management at Rockhurst University is known internationally for its superior development of values-driven business leaders. The main distinctions are program structure, delivery model, and format. The EMBA accommodates working students further along in their careers. Other. Thus, the major difference between the MBA and Executive MBA is that students can work and study together. Executive MBA courses are often school evenings or. While a conventional MBA may prepare someone to enter a management career, an Executive MBA is intended to teach a current leader how to be a more effective. An executive MBA cohort will cater to older professionals who have more work experience, while the candidates of part-time programs typically have similar. The key differences between an Executive MBA Program and a Full-Time MBA Program involve timing, location, and career profiles. Executive MBA students are. Want to know the difference between MBA and executive MBA? We at Yocket have prepared a complete guide with detailed diff between MBA and executive MBA. An MBA, short for Master of Business Administration, is a general management degree. There are one and two-year programs, but both tend to be full-time and. The primary difference between an MBA and an EMBA is that an MBA caters to early to mid-career professionals as well as those looking to switch industries. An. The Helzberg School of Management at Rockhurst University is known internationally for its superior development of values-driven business leaders. The main distinctions are program structure, delivery model, and format. The EMBA accommodates working students further along in their careers. Other. Thus, the major difference between the MBA and Executive MBA is that students can work and study together. Executive MBA courses are often school evenings or. While a conventional MBA may prepare someone to enter a management career, an Executive MBA is intended to teach a current leader how to be a more effective. An executive MBA cohort will cater to older professionals who have more work experience, while the candidates of part-time programs typically have similar. The key differences between an Executive MBA Program and a Full-Time MBA Program involve timing, location, and career profiles. Executive MBA students are. Want to know the difference between MBA and executive MBA? We at Yocket have prepared a complete guide with detailed diff between MBA and executive MBA. An MBA, short for Master of Business Administration, is a general management degree. There are one and two-year programs, but both tend to be full-time and.

1. Executive MBA Programs Usually Require More Experience. Some traditional MBA programs require work experience, but an EMBA usually requires five or more. EMBAs and MBAs (full-time or part-time) are fundamentally different. Below are a few points to illustrate their differences that can help you determine which. Executive MBA programs are designed for individuals who are already well-versed in the business world, whereas MBA programs are more flexible, accommodating. An executive MBA program referred to as an EMBA enables executives to earn the degree while continuing to hold their existing jobs. An Executive MBA is designed for experienced professionals with significant work experience and is typically completed while working part-time. In contrast, a. Most schools use case studies for practice, but these do not involve real-world application from the students' workplaces. One notable exception is the. This blog will delve into these three different formats, focusing on the comparison of the Online MBA vs Executive MBA, to help you make an informed decision. The content and curriculum of an Executive MBA is quite similar to an MBA, however, typically there will be more emphasis on individual leadership development. An executive MBA is very different from a regular MBA in terms of campus life, interactions, social life, student demographics, Executive MBA fees and much. An EMBA program enriches students with a more in-depth knowledge of business management, process, markets, and tools. This, coupled with lesser effort and time. Course structure: An executive MBA usually covers the same classes as a traditional, albeit at a faster rate. Also, EMBA programmes offer fewer electives as. EMBAs are superior to MBAs. They're essentially the same degree, but EMBAs are structured for current (rather than aspiring) executives and tend to be more. An overview of the differences between Executive MBA programs, which are designed for students with five-to-ten years of professional business experience. The difference between an EMBA and an MBA is that the coursework is less about general knowledge and more focused on refining skills through specific. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. The key difference between an Executive MBA (EMBA) and a regular MBA lies in their target audience, format, and experience level required. Differences between Executive MBA vs Full-Time MBA A Full-Time MBA differs from an Executive MBA in essentially these aspects – Target student profile and. Executive MBA vs MBA. An EMBA is similar to a Master of Business Administration Program in terms of qualifications and requirements. What sets these two. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. An MBA is an advanced business degree program that prepares students to become business leaders in many areas, such as finance, marketing, human resources, and.

Nigeria Vpn

PIA VPN for Nigeria guarantees private and safe internet access. Connect to fast Nigerian servers for more anonymity even on public Wi-Fi hotspots. Enterprise VPN is our managed last-mile communications network solution. It enables medium and large enterprises to connect their sites across Nigeria and the. Connect to the Internet with an IP address in Nigeria. Access Nigeria-only sites and services from anywhere in the world. This guide will walk you through the process of accessing YouTube Premium at Nigerian rates, offering a significant discount compared to standard pricing in. What are the best VPNs for Nigeria? · ExpressVPN - The best Nigeria VPN. · NordVPN - The best value VPN for Nigeria. · Surfshark - Surfshark is the best multi-. VPNs are legal in Nigeria, but their usage is subject to certain restrictions. The Nigerian Communications Commission (NCC) oversees the. Connect to Nigeria VPN servers, switch IP address, bypass online censorship, get access to global internet, and browse privately even on open WiFi networks. Top 5 best VPN services to use in Nigeria · CyberGhost – the best VPN for Nigeria · ExpressVPN – the fastest VPN service · NordVPN – security-oriented Nigeria. Nigeria VPN: Secure virtual locations. Connect to fast and reliable virtual VPN servers for Nigeria. Boost your online security and privacy on up to 10 devices. PIA VPN for Nigeria guarantees private and safe internet access. Connect to fast Nigerian servers for more anonymity even on public Wi-Fi hotspots. Enterprise VPN is our managed last-mile communications network solution. It enables medium and large enterprises to connect their sites across Nigeria and the. Connect to the Internet with an IP address in Nigeria. Access Nigeria-only sites and services from anywhere in the world. This guide will walk you through the process of accessing YouTube Premium at Nigerian rates, offering a significant discount compared to standard pricing in. What are the best VPNs for Nigeria? · ExpressVPN - The best Nigeria VPN. · NordVPN - The best value VPN for Nigeria. · Surfshark - Surfshark is the best multi-. VPNs are legal in Nigeria, but their usage is subject to certain restrictions. The Nigerian Communications Commission (NCC) oversees the. Connect to Nigeria VPN servers, switch IP address, bypass online censorship, get access to global internet, and browse privately even on open WiFi networks. Top 5 best VPN services to use in Nigeria · CyberGhost – the best VPN for Nigeria · ExpressVPN – the fastest VPN service · NordVPN – security-oriented Nigeria. Nigeria VPN: Secure virtual locations. Connect to fast and reliable virtual VPN servers for Nigeria. Boost your online security and privacy on up to 10 devices.

Learn how FineVPN's free VPN service offers unparalleled access, security, and speed for Nigerians seeking online freedom and privacy. With our Nigeria VPN, you can keep your information safe from hackers on both public and private Wi-Fi networks using AES bit encryption. Download the APK of VPN Nigeria - Turbo Master VPN for Android for free. Secure, fast VPN for unrestricted, private internet access worldwide. Experience. Discover the best VPN for Nigeria in Learn why use a VPN, how to connect, and why VPN - Super Unlimited Proxy is the top choice. Download our free Nigeria VPN and enjoy the best experience online that internet freedom has to offer. Our server provides the fastest possible speed for all of. Turbo VPN Extension for Chrome browser provides you with free and unlimited access to all blocked websites and network protection for your online activities. Nigeria VPN is easy. If you are not satisfied, we will refund your payment. No hassle, no risk. Free VPN is the safest, most private, and most secure VPN on the App Store. Unlike our competition, we don't require a login and we never store or collect user. Try our secure Nigerian VPN for unlimited streaming with a Nigeria IP. Experience unrestricted browsing like never before. Meet the real Free VPN! Get Free VPN access at the best security level with super fast connection. Free VPN never logs any of your personal data. 8prestigespin.ru offer Free VPN in Nigeria. Browse the internet freely, secure and undetected with free nigerian IP address. % anonymous. By using Proton VPN, you can connect to our fast, reliable, and secure servers in Nigeria and browse the internet using a Nigerian IP address. Hotspot Shield is the best free VPN for unblocking content and browsing anonymously in Nigeria. Hotspot Shield is fast, secure, and free. Download today! TeraVPN is the world's largest anonymous web network. We provide top VPN speed and security for free through IP sharing. A day money-back promise Use. How do I get a Nigeria IP address on my phone? PIA makes it simple to get a Nigeria IP address on your phone. Just download and install our Android VPN or iOS. Use fast and free VPN by AdGuard to unblock Nigerian websites while travelling or access foreign content from Nigeria. Surf the Web privately with a. Telleport services in Nigeria. Best free VPN service on Windows, Android and Chrome. Secure and Private Access to restricted content from around the world. Nigeria Dedicated IP VPN SERVICE. VPN account with Nigerian dedicated IP address offers more secured access to any web resource. Compared to regular VPN. CyberGhost VPN masks your IP address and encrypts your traffic to help you avoid surveillance and cybercriminals. You can also use it to unblock content. Download the latest version of VPN Nigeria - Turbo Master VPN for Android. Secure, fast VPN for unrestricted, private internet access worldwide. Experience.

Best Savings A

The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. savings accounts with a balance of $ as reported by Curinos as of 09/08/ National average is based on information regarding the top 50 banks (by deposit. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — %. Bank Savings Account comes with tools to help grow your money faster. We The interests rates are the best I've seen and my savings has grown more. We've compared savings accounts at 35 nationally available banks and credit unions to find some of the best options available. Bank of America Home · Contact Us · Locations · Help · Schedule an appointment · En español · En español. Top Deposit Links Top Deposit Links. Account Rates. The most recent rates from the FDIC put the national savings APY average at %, while there are many high-yield savings accounts that offer a % APY or. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. The top savings accounts rates on Raisin. Offered by FDIC-insured banks and NCUA-insured credit unions. Start with as little as $1 and no fees. Learn more. savings accounts with a balance of $ as reported by Curinos as of 09/08/ National average is based on information regarding the top 50 banks (by deposit. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — %. Bank Savings Account comes with tools to help grow your money faster. We The interests rates are the best I've seen and my savings has grown more. We've compared savings accounts at 35 nationally available banks and credit unions to find some of the best options available. Bank of America Home · Contact Us · Locations · Help · Schedule an appointment · En español · En español. Top Deposit Links Top Deposit Links. Account Rates. The most recent rates from the FDIC put the national savings APY average at %, while there are many high-yield savings accounts that offer a % APY or. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum.

Savings Accounts · Best High-Yield Savings Accounts · Best Money Market Accounts · Best Savings Account for a Child. The best high-yield savings account can get you more than 5% for your cash, although you'll have to be comfortable with online banking to get the best. With a money market account, you may be able to get a better interest rate than you would with a regular savings or checking account, while maintaining. savings goals faster by earning interest at a higher rate than traditional savings accounts Sallie Mae named one of the best savings accounts, money market. Here's a short list of good online banks with >5% APY. There are others, this is just my short list. western alliance cit sofi jenius everbank. Choose the best savings account from the top registered and non-registered plans in Canada by comparing interest rates, fees and convenience. Earn up to % interest per annum, with monthly credit on your savings account. Maximize your savings with IDFC FIRST Bank's competitive interest rates. Best Savings Accounts - Editors' Picks ; High-Yield, My Banking Direct High Yield Savings Account, % ; $,+ Balances, Poppy Bank Premier Online. Territorial Savings Bank Hawaii has multiple account options to choose from, all with access to online banking. Set up your savings account today. Best High-Yield Savings Accounts · Poppy Bank Premier Online Savings · Western Alliance Bank · Forbright Bank Growth Savings · Vio Bank Cornerstone Money Market. Banner's Best is our highest earning savings account and features unlimited ATM withdrawals and overdraft protection. Compare top-rated banks · Review our top banks of · EverBank · Synchrony Bank · UFB Direct · SoFi Bank. Many savings accounts offer interest rates over 3%. Compare our top picks for the best savings accounts and interest rates, and find the right option for. Another great option. Great APY, no maintenance fees, or minimum balances—you can't go wrong with a Barclays online savings account. Some of the top banks with the highest interest rates are Customers Bank, TAB Bank, Cloud, UFB, Bread, Bask, Upgrade, Varo and more. A cash ISA is the likely winner if you pay tax on savings interest (most don't). Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. The right savings options can make it easier for you to get where you want to go. Take a look at the different types of savings accounts below to find the best. To qualify for the New Member Savings, you must be a new member, open and maintain, in good standing, a qualified Advantis checking account and maintain a.

How To Have Good Credit Without Credit Card

Building Credit Without Credit Cards · Understanding Your FICO Score · Keep Paying Old Bills · Report Your Rent · Take a Loan · Open a Store Credit Account · Check. With no credit history, you might qualify for a secured credit card. A secured card requires you to keep a certain amount of money on deposit, which then serves. Pay bills on time: The most important factor when it comes to building good credit is debt payment history, accounting for 35% of your FICO score. Making full. Use credit wisely and build a good credit history · Don't max out your card. You will need to use your credit card to build a credit history but take it easy. 10 keys to building good credit · Be patient with yourself. · Choose a good financial institution. · Start small and then expand. · Use your credit card responsibly. One option for an unsecured credit card for an applicant with no credit history is a student credit card. Student credit cards don't require a deposit like. 1. Get on the electoral roll · 2. Make sure your name is on household bills · 3. Take out a personal loan · 4. Repay outstanding debts · 5. Remove financial links. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. You could also open a secured credit card. These are easy to obtain approval for without credit history. Capital One & Discover are good options. Building Credit Without Credit Cards · Understanding Your FICO Score · Keep Paying Old Bills · Report Your Rent · Take a Loan · Open a Store Credit Account · Check. With no credit history, you might qualify for a secured credit card. A secured card requires you to keep a certain amount of money on deposit, which then serves. Pay bills on time: The most important factor when it comes to building good credit is debt payment history, accounting for 35% of your FICO score. Making full. Use credit wisely and build a good credit history · Don't max out your card. You will need to use your credit card to build a credit history but take it easy. 10 keys to building good credit · Be patient with yourself. · Choose a good financial institution. · Start small and then expand. · Use your credit card responsibly. One option for an unsecured credit card for an applicant with no credit history is a student credit card. Student credit cards don't require a deposit like. 1. Get on the electoral roll · 2. Make sure your name is on household bills · 3. Take out a personal loan · 4. Repay outstanding debts · 5. Remove financial links. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. You could also open a secured credit card. These are easy to obtain approval for without credit history. Capital One & Discover are good options.

A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Extra members who use the product as recommended were more likely to achieve and maintain good credit scores than consumers who demonstrated healthy credit. Secured credit cards: Many credit card companies offer secured credit cards to consumers with no credit or bad credit. You qualify for this type of credit card. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Learn how you can begin building credit for the first time. No matter your income or age, these tips can help guide you to earning a great credit score. For example, a positive credit history can help you access consumer loans at a lower interest rate, or qualify for a credit card with a lucrative rewards. It may seem counter intuitive at first, but utilizing at least 1% but less than 30% of your credit is actually better for your credit score than 0% utilization. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card. Opening a credit card, becoming an authorized user and applying for a credit-builder loan are some ways to establish credit. · Building good credit relies on. Stay informed. You need to know what's on your credit report and how it's affecting your score. · Options like a secured credit card or piggybacking are great. Kikoff is a credit-building platform (similar to the aforementioned TomoBoost program) that allows users to build credit without a credit check. For a small. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. But there are a few new companies, such as Rental Kharma4 and RentTrack,5 which can report your payments to the credit bureaus for a small fee. This is a great. Become an authorized user If you have a friend or family member with good credit, ask them to add you as an authorized user to their credit cards. You'll get. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. In most cases, a secured credit card will be the easiest to get approved for even with no credit history. You simply need a small cash deposit to open a credit. Learn how to build your credit for free—no credit score required ̍ Step Visa Card is designed to help build positive credit history. Positive. One of the fastest ways to build good credit is by paying your bills on time. Creditors like to see a solid track record of responsibility. 8 ways to build your credit without a credit card · 1. Get a Credit Builder Loan · 2. Use KOHO's Credit Building Option · 3. Report Regular Payments to Credit. Options to start your credit history · Store credit cards. Some folks turn to store credit cards as they try to build credit. · Credit builder loans. Many.

1 2 3 4 5